MONTHLY NEWSLETTER

- 1. Market Updates

- 2. Midlands Property Investor Awards

- 3. Capital Raise

- 4. Firs Street Apartments

- 5. Coming Soon: "Investire" Platform

Bringing you the latest news and insights in Trinity Assets!

Market Updates

Interest Rates

- Bank of England keeps rates at 5.25% in ‘finely balanced’ decision; traders lift bets for August cut.

- The Bank of England voted to hold interest rates at its June meeting, which met market expectations after U.K. inflation fell to the central bank’s 2% target.

Rental Demand

- “With the population predicted to grow by 10% over the next decade, it is clear demand for rental homes is only going to go up – particularly in towns and cities with robust job markets. Buy Association Group

We have been nominated for “Property Investor of the Year” award at the Midlands Property Investment Award 2024

We have been nominated for “Property Investor of the Year” award at the Midlands Property Investment Award 2024

Last year we had the privilege of winning the award for Property Investor of the Year. We are delighted to announce that we are finalists yet again for this award at the Midlands Property Investment Awards this September!

The Midland Property & Investment Awards are a celebration of the remarkable innovation and high standards within the Midlands property sector.

The awards give recognition to the significant accomplishments of businesses, groups, and individuals who have played a role

in the expansion and progression of the local property industry.

We want to express our deepest gratitude for your continued support throughout this process.

We have been nominated for “Property Investor of the Year” award at the Midlands Property Investment Award 2024

We have been nominated for “Property Investor of the Year” award at the Midlands Property Investment Award 2024

Last year we had the privilege of winning the award for Property Investor of the Year. We are delighted to announce that we are finalists yet again for this award at the Midlands Property Investment Awards this September!

The Midland Property & Investment Awards are a celebration of the remarkable innovation and high standards within the Midlands property sector. The awards give recognition to the significant accomplishments of businesses, groups, and individuals who have played a role in the expansion and progression of the local property industry.

We want to express our deepest gratitude for your continued support throughout this process.

Capital Raise

I am thrilled to share the exciting news that We have successfully concluded our recent capital raise campaign. Thanks to the unwavering support and confidence of our investors, we have surpassed our initial fundraising goals.

This milestone is a testament to the strength of our business model, the dedication of our team, and the compelling vision we have for the future. The funds raised will be instrumental in accelerating our growth plans, including the development of our co-living schemes in the West Midlands.

We are incredibly grateful to all our investors for their trust and commitment. Your belief in our vision has been a driving force behind our efforts, and we are eager to demonstrate the impact of your investment.

Capital Raise

I am thrilled to share the exciting news that We have successfully concluded our recent capital raise campaign. Thanks to the unwavering support and confidence of our investors, we have surpassed our initial fundraising goals.

This milestone is a testament to the strength of our business model, the dedication of our team, and the compelling vision we have for the future. The funds raised will be instrumental in accelerating our growth plans, including the development of our co-living schemes in the West Midlands.

We are incredibly grateful to all our investors for their trust and commitment. Your belief in our vision has been a driving force behind our efforts, and we are eager to demonstrate the impact of your investment.

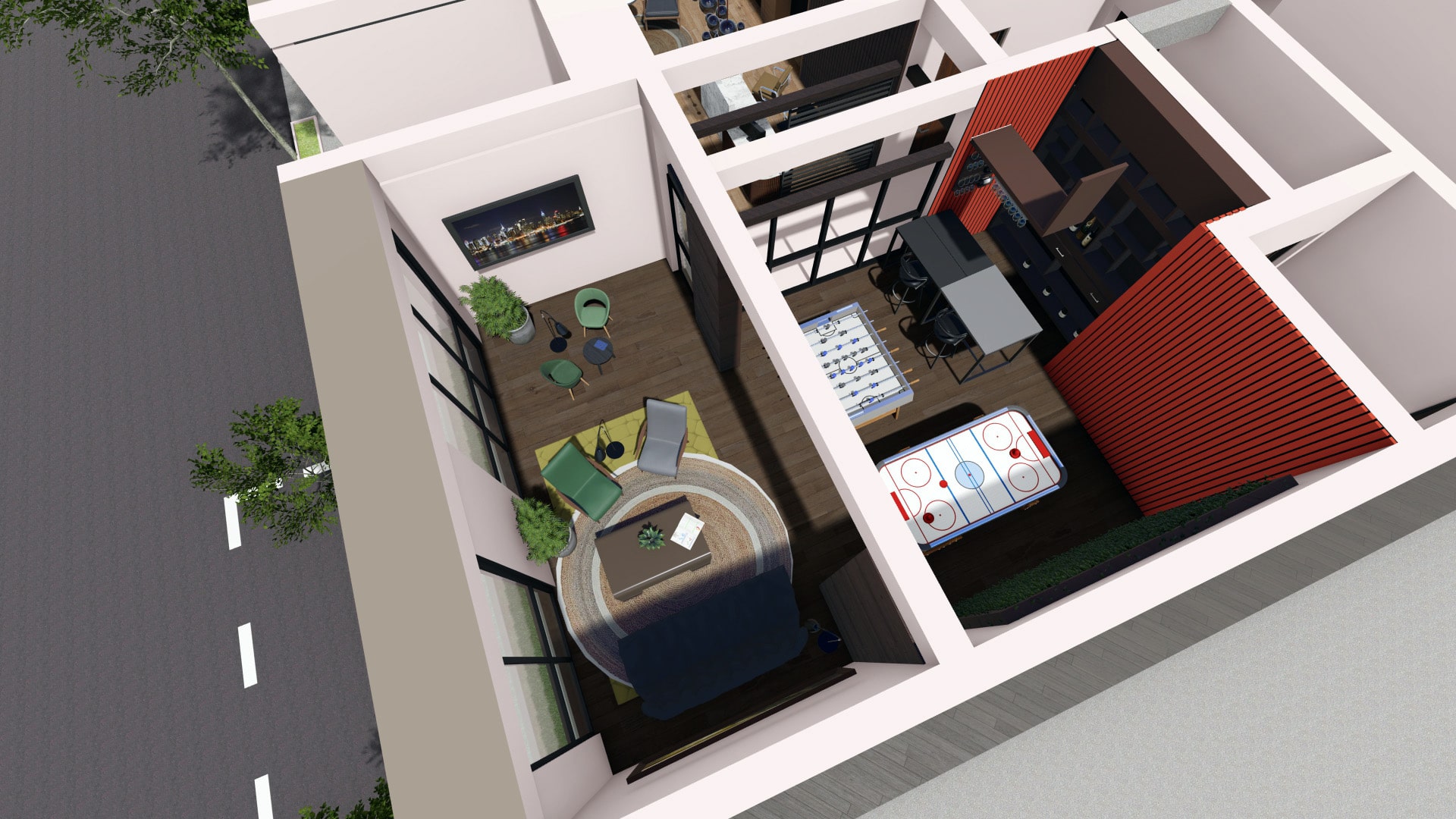

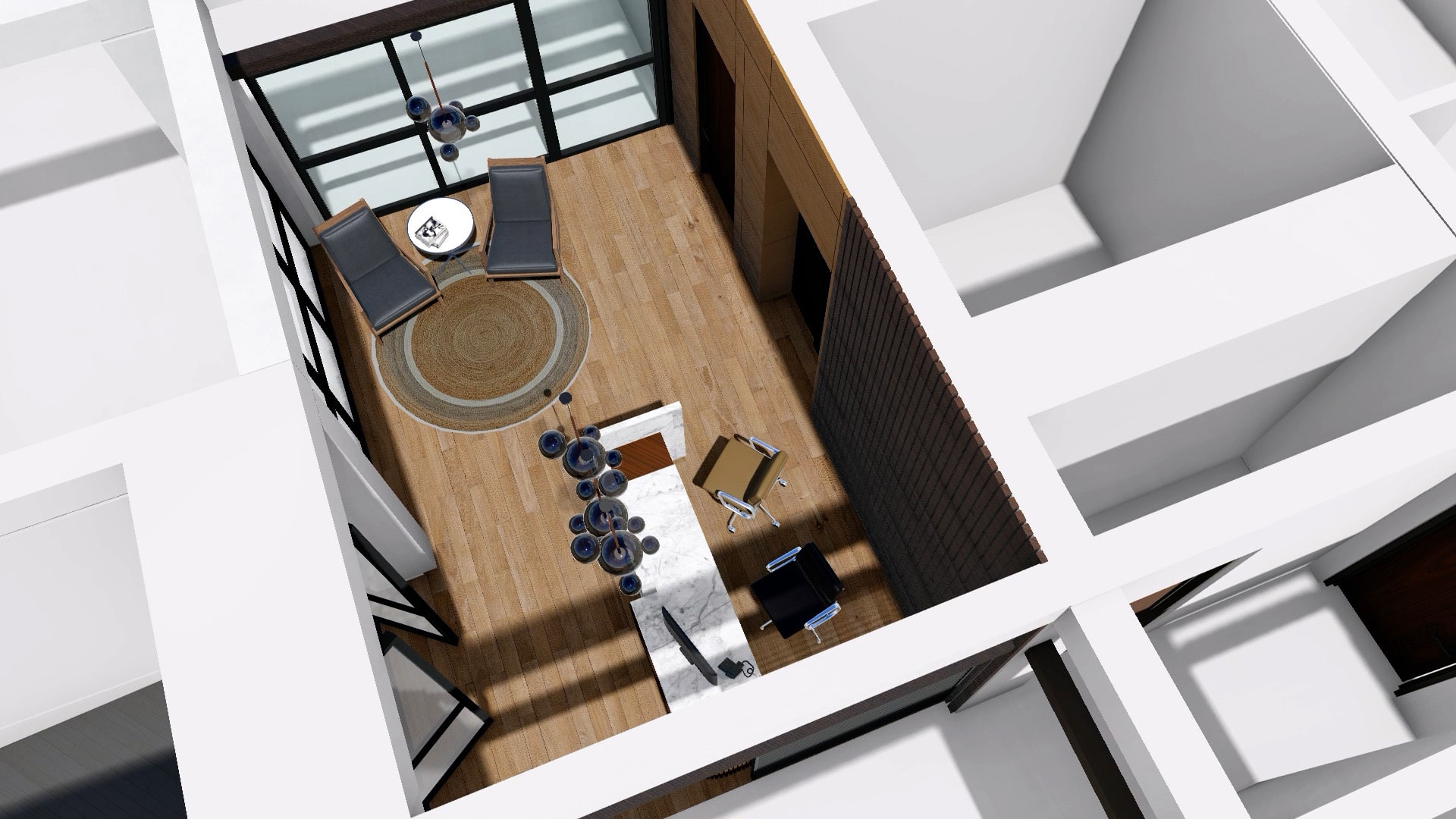

Completed Project: Firs Street

We are delighted to announce the completion of our new apartments located on Firs Street, Dudley

These Firs Street apartments represent our commitment to providing high-quality, modern living spaces to our residents. From the sleek contemporary design to the thoughtful amenities, everything has been carefully considered to ensure the utmost comfort for our residents

We are pleased to share that we have warmly welcomed our new residents into their homes at the Firs Street Apartments.

Coming Soon - "INVESTIRE" Web Application for our Clients

We will be launching our INVESTIRE platform for managing our investors, it is a specialised tool designed to streamline and enhance the interaction between us and our investors. This system enables us to track and manage our investor relationships, ensuring efficient communication, data organisation, and engagement.

Key features include:

Contact Management: Centralizes investor information, including contact details, investment history, and communication logs.

Document Management: Stores important documents such as investment agreements, financial reports, and meeting notes.

Tracking and Analytics: Monitors investment performance, tracks engagement metrics, and provides insights

Compliance and Security: Ensures data privacy and regulatory compliance with secure access controls and audit trails.

The INVESTIRE platform for managing investors allows us to build strong relationships, improves transparency, and supports strategic decision-making by providing a comprehensive view of our investor interactions and portfolio performance.

Contact us

Name

Trinity Assests

info@trinityassetmanagement.co.uk

Phone

+44 121 517 0054